”

”

Hazardous Materials Diamond: Your Safety Guide

Understanding the dangers of hazardous materials is crucial for anyone who works with them or is near them. The Hazardous Materials Diamond, also known as the NFPA 704 hazard rating system, provides a simple yet effective way to identify these risks at a glance.

This system uses a universally recognized symbol to communicate potential hazards, helping to ensure preparedness and safe handling in emergencies. Let’s dive into what this diamond means and how it protects us.

What is the Hazardous Materials Diamond?

The Hazardous Materials Diamond, officially the NFPA 704 Standard System for the Identification of the Hazards of Materials for Emergency Response, was developed by the National Fire Protection Association (NFPA). Its primary purpose is to offer a clear and concise way for emergency responders and the public to understand the risks associated with a particular substance or mixture.

Think of it as a quick-reference guide. It’s designed to be easily understood, even under stressful emergency conditions. This system is commonly seen on buildings, storage tanks, and transport vehicles where hazardous substances are present.

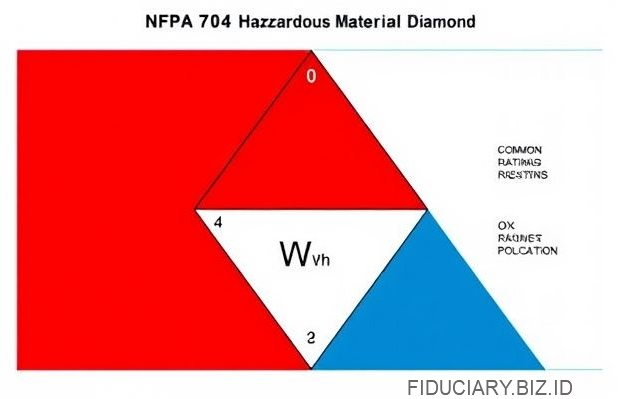

The NFPA 704 Symbol Explained

The core of the NFPA 704 system is the diamond-shaped symbol. This diamond is divided into four colored quadrants, each representing a different type of hazard.

- Blue: Health Hazard

- Red: Flammability Hazard

- Yellow: Instability Hazard

- White: Special Hazards

Each of these colored sections is assigned a numerical rating from 0 to 4, with 4 indicating the most severe hazard and 0 indicating the least. This numerical rating provides an additional layer of detail to the color-coded quadrants.

Decoding the Colors and Numbers

Let’s break down what each color and its corresponding number signify. This detailed understanding is key to safely interacting with hazardous materials.

The Blue Quadrant: Health Hazard

The blue section of the diamond tells us about the potential health effects of a material. This can include anything from mild irritation to severe, long-term health problems or even death.

Health Hazard Ratings (0–4)

- 4: Materials that can cause death or serious, permanent damage through very short-term exposure. Examples include hydrogen cyanide or phosgene.

- 3: Materials that can cause serious temporary or residual injury, even though prompt medical attention may prevent lasting damage. Examples include chlorine or anhydrous ammonia.

- 2: Materials that are short-term exposures which could cause serious temporary or residual injury. Examples include acetone or carbon tetrachloride.

- 1: Materials that would offer only moderate or minor danger to health. Examples include ethyl acetate or mineral oil.

- 0: Materials that present no significant health hazard under normal conditions of use or exposure. Examples include nitrogen or helium.

Understanding the health hazard is crucial for personal protective equipment (PPE) selection and emergency response procedures.

The Red Quadrant: Flammability Hazard

The red section addresses how easily a material can ignite and burn. This is a critical factor in preventing fires and explosions.

Flammability Hazard Ratings (0–4)

- 4: Materials that will vaporize readily and burn at all ordinary temperatures and will burn with extreme rapid burning or decomposition. Examples include acetylene or propane.

- 3: Liquids and gases that have a flash point below 73°F (23°C) and have a boiling point below 100°F (38°C). Examples include gasoline or ethyl ether.

- 2: Materials that must be moderately heated or exposed to relatively high ambient temperatures before ignition can occur. Examples include diesel fuel or kerosene.

- 1: Materials that must be preheated before ignition can occur. Examples include lubricating oil or some plastics.

- 0: Materials that will not burn under normal conditions. Examples include water or carbon dioxide.

The flammability rating helps determine appropriate fire suppression methods and the need for ventilation.

The Yellow Quadrant: Instability Hazard

The yellow section of the diamond indicates a material’s susceptibility to explosion or violent reaction. This can be due to factors like heat, shock, or contact with other substances.

Instability Hazard Ratings (0–4)

- 4: Materials that are readily capable of detonation or explosive decomposition or explosive reaction at normal temperatures and pressures. Examples include nitroglycerin or TNT.

- 3: Materials that may detonate or explode but require a strong initiating source or that only detonate or explode under confinement. Examples include sodium azide or uranium hexafluoride.

- 2: Materials that are normally stable but can become unstable when heated or subjected to shock. Examples include acetylene or certain organic peroxides.

- 1: Materials that are normally stable, but may become unstable when heated. Examples include anhydrous ammonia or chlorine.

- 0: Materials that are normally stable, even under fire exposure conditions, and are not reactive with water. Examples include helium or neon.

This rating is essential for understanding storage requirements and how to handle materials that might react unexpectedly.

The White Quadrant: Special Hazards

The white section is reserved for special or unusual hazards that don’t fit into the other categories. These symbols provide additional, specific information.

Common Special Hazard Symbols:

- W with a slash through it (⦀): Reacts with water. This indicates that a material can produce hazardous gases or vapors when mixed with water, or it might react violently with water. For instance, sodium metal or calcium carbide fall into this category.

- OX: Oxidizer. These materials, like hydrogen peroxide or potassium permanganate, can intensify fires by providing oxygen. They don’t necessarily burn themselves, but they make other materials burn more readily and intensely.

- COR: Corrosive. This symbol is often used to indicate materials that can damage or destroy other substances or living tissue upon contact. Strong acids like sulfuric acid or strong bases like sodium hydroxide might be labeled with this, though it’s not part of the primary NFPA 704 numbering system.

- HIC: Highly Flammable Gas.

- IC: Ichthyotoxicity (harmful to fish).

- PYR: Pyrophoric (ignites spontaneously in air).

These special hazard symbols are vital for understanding unique risks and implementing specific safety protocols.

Why is the Hazardous Materials Diamond Important?

The NFPA 704 hazard rating system plays a critical role in safety across various industries and public spaces. Its simplicity and universal nature make it an invaluable tool for hazard communication.

Emergency Preparedness

For firefighters and other emergency responders, the diamond provides immediate, crucial information about the dangers they face upon arriving at a scene. This allows them to select the correct protective gear and implement the most effective response strategy, minimizing risks to themselves and the public.

Workplace Safety

In industrial settings, the Hazardous Materials Diamond helps employees identify and understand the risks associated with the chemicals they handle daily. This knowledge empowers them to follow proper safety procedures, use appropriate personal protective equipment (PPE), and prevent accidents.

Public Awareness

Even the general public can benefit from understanding the diamond. Seeing these symbols on storage facilities or transportation vehicles can alert people to the presence of hazardous substances and encourage them to maintain a safe distance or take necessary precautions.

Examples of Hazardous Materials and Their Diamond Ratings

Let’s look at a few common hazardous materials and how they might be represented on the NFPA 704 diamond. Remember, specific ratings can vary slightly depending on concentration and form.

| Material | Health (Blue) | Flammability (Red) | Instability (Yellow) | Special Hazards (White) |

|---|---|---|---|---|

| Gasoline | 1 | 3 | 0 | None |

| Acetone | 2 | 3 | 0 | None |

| Sulfuric Acid (concentrated) | 3 | 0 | 0 | W (Reacts with water), COR (Corrosive) |

| Propane | 0 | 4 | 0 | None |

| Chlorine Gas | 3 | 0 | 1 | None |

| Nitroglycerin | 2 | 1 | 4 | None |

These examples highlight how different materials present a unique combination of risks. The diamond provides a swift overview of these dangers.

Limitations of the Hazardous Materials Diamond

While incredibly useful, the NFPA 704 system has some limitations that are important to acknowledge. It’s designed for immediate, general hazard identification, not for comprehensive chemical analysis.

- Not a Substitute for SDS: The diamond doesn’t provide detailed information on specific health effects, first aid measures, or exact safe handling procedures. For that level of detail, a Safety Data Sheet (SDS) is essential.

- General Information: The ratings are general. For example, “3” for health hazard means it can cause serious temporary or residual injury, but the exact nature of that injury isn’t specified.

- Limited Scope: It doesn’t cover all possible hazards. Chronic health effects, carcinogenicity, or specific environmental hazards might not be fully represented.

- Not for Consumer Products: The NFPA 704 system is primarily intended for industrial and emergency response use, not for labeling consumer products found in homes.

Always consult the Safety Data Sheet (SDS) for complete information on any hazardous material.

Conclusion: Safety First with the Diamond

The Hazardous Materials Diamond is an indispensable tool for understanding and communicating the risks associated with dangerous substances. By familiarizing yourself with its color-coded quadrants and numerical ratings, you can significantly enhance safety awareness and preparedness.

Remember, this diamond is a guide, a first line of information. Always prioritize safety, follow proper procedures, and never hesitate to seek further information from SDSs or safety professionals when dealing with hazardous materials.

What are your thoughts on the Hazardous Materials Diamond? Have you encountered it before? Share your experiences in the comments below!

“